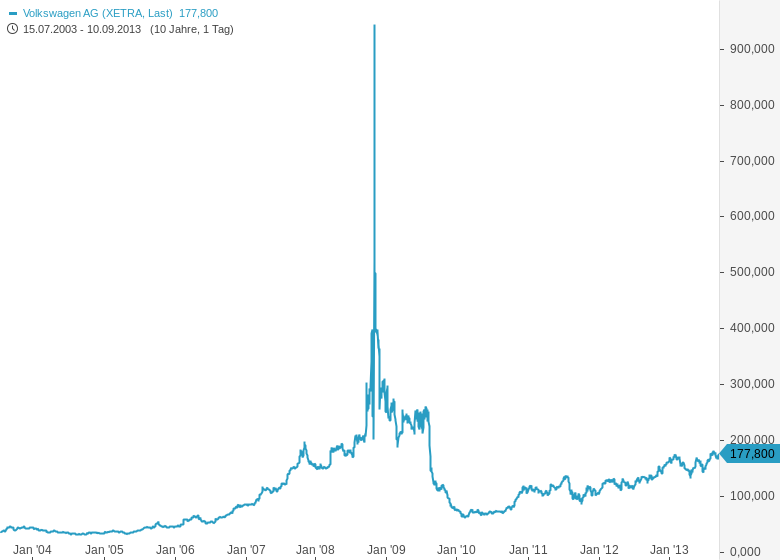

It meant that traders may have been indirectly and inadvertently borrowing shares from Porsche, selling them to Porsche, buying them back from Porsche and then returning them to Porsche. What upset the hedge funds is that, because Porsche had not declared the proportion of VW shares it controlled, it’s likely that many of the funds that shorted VW had borrowed the shares from Porsche. For a short period, VW was valued at €296BN, which is higher than the €275BN value of Exxon Mobil – previously the world’s most valuable company. VW’s shares peaked at €1,005 each, not their usual €250, as traders scrambled to cut their losses. Having engineered the most vicious of “Short Squeezes”, the Porsche financial team waited three days before telling the hedge funds that they would release 5% of VW shares to get them off the hook-at a price. It meant that, the hedge funds had to buy 13% of the shares and only 5% were available. Why? Since the German state of Lower Saxony holds just over 20% of VW, Porsche’s disclosure meant that, in fact, there were only 5% of VW’s shares left on the market (’the Float’), whereas hedge funds had borrowed 13% of the shares and sold them short. However, when Porsche announced that, in addition to the 44% of Volkswagen’s shares it owned, it had secured control of another 31% through cash-settled call options, the invisible market in VW shares went ballistic.

It amounts to placing a bet on the share price dropping, is a favoured move of hedge funds, and has been recently blamed for much of the current economic mayhem. Short selling is basically the practice of selling borrowed shares, with the intention of purchasing them back later at a lower price.

0 kommentar(er)

0 kommentar(er)